The 22nd annual Investor Day was held on December 12, 2023. Dedicated principally to the Group’s unlisted companies, Investor Day is an opportunity for the financial community to get to know the executives of the Group’s companies and the long-term value creation potential of its portfolio.

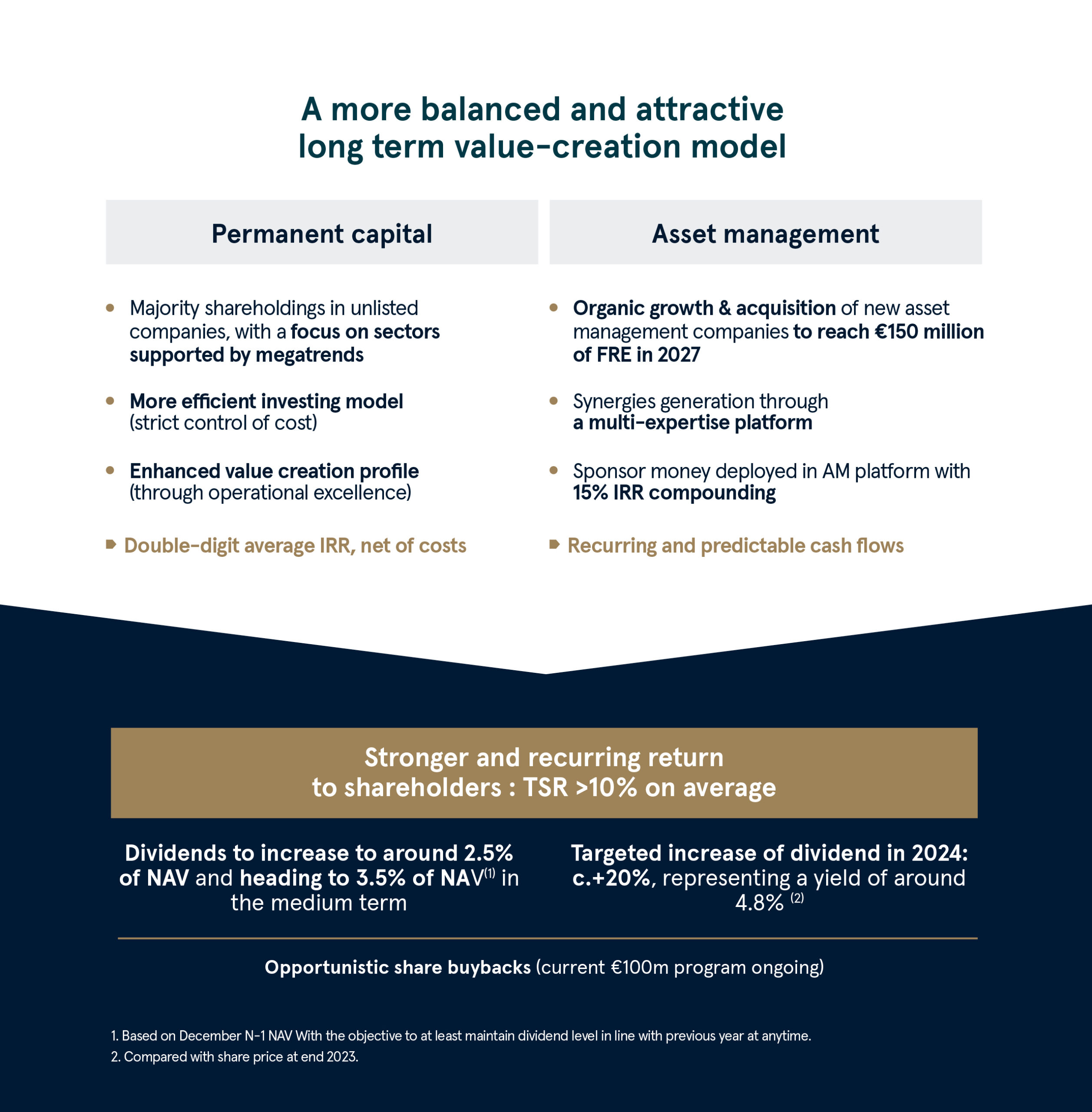

First and foremost, this Investor Day was an opportunity for the Executive Board to present the Group’s strategy, oriented around value creation and a recurrent return to shareholders, and Wendel’s goal to build a dual model based on two lines of business, permanent capital and third-party private asset management.

Finally, this Investor Day was especially an opportunity for certain company executives to address shareholders directly and answer their questions. As such, Maarten Heijbroek presented Stahl’s positive financials, demonstrating his company’s consistent, sound performance, despite a challenging economic context. Two other executives, Christopher Masek, CEO of IK Partners, and Yvan Chabanne, CEO of Scalian, presented their companies and fielded shareholders’ questions for the first time.

3 questions for Christopher Masek

IK Partners has a very solid track record. What are the drivers of this success?

What defines success in our industry is consistently high cash returns. To achieve this, IK Partners focuses on three core ingredients: positioning, selectivity and engagement. For over three decades, IK Partners has established a leading position across Europe in, what we qualify as, the lower mid-market where valuations range from €100 million to €450 million. This field is attractive due to: the large number of opportunities to choose from; lower entry multiples; availability of financing; greater development potential for the underlying companies and; significantly more optionality when considering an exit.

Positioning – IK Partners has a 100-strong Investment team across seven offices covering this space. With the benefit of numbers relative to peers, (larger teams, greater investment capacity and broader international coverage) we are able to successfully invest in fast-growing companies not covered by larger institutions.

Selectivity – IK Partners focuses on quality assets with: high levels of demonstrated double-digit organic growth; strong profitability and cashflow; market leadership; and a clear path to at least double in size, in particular through buy-and-build. This allows for greater focus and transformational success.

Engagement – We are a hands-on investor with strong Investment teams and significant in-house Operations, Capital Markets and ESG resources, fully integrated throughout the investment lifecycle. Our teams provide a proactive support which enables us to transform local champions into international leaders which, upon exit, possess a: broader offering; stronger platform (IT, Operations, Finance); and defined roadmap for moving to the next level.

What is the advantage for IK Partners of partnering with an investment company like Wendel?

With Wendel’s strong institutional positioning, we anticipate even more opportunities and, most importantly, we will have the means to further invest into our platform and broaden our geographic coverage. We’ll also have the ability to add logical strategical adjacencies to further reinforce our European mid-market positioning. With Wendel’s support, we plan to open an office in Munich in order to strengthen our offering in the highly attractive DACH region and expand into Southern Europe where we will pursue our systematic coverage of the European market; something our investor base is seeking. We will also plan to broaden our North American investor base by leveraging Wendel’s established presence in New York.

The opportunity to partner with Wendel is timely. We believe that our forthcoming partnership is one based on positive dynamics— shared values, mutual respect and with clearly-defined objectives and responsibilities. Wendel, with its over three-hundred-year history of carefully planned growth based on purpose, is, in this respect, the perfect partner for our next phase of growth.

In turn, we believe that the IK Partners platform with its unique market position, long trackrecord of top performing and consistent returns, ambitious teams with a clear roadmap for growth in a highly attractive industry, will yield strong financial and strategic benefits for Wendel in the decades to come.

What are your preferred markets and sectors? What criteria do you use to select the companies in which you invest?

We invest between €10m—€300m of equity in companies typically valued between €25m—€1bn, across four complementary strategies (Mid Cap, Small Cap, Development Capital and Partnership Fund) across seven regional offices. Our diverse team operates across four sector groups each comprising individuals from all geographies, investment strategies and operations functions. Whilst the sector references are broad, our teams work to identify distinct trends and focus their efforts on defined subsectors representing an estimated 31% of the overall addressable European market. Our selection of these subsectors is based upon identification of core fundamental trends which we regularly challenge, combined with the pursued replication of our extensive experience.

3 questions for Yvan Chabanne

Scalian has performed well over the past ten years. What makes your model unique? What future trends are developing and what is the outlook for them?

Scalian offers expertise and solutions in two key areas that address industry challenges: digital technology and performance management.

Our organization is aligned with our positioning, enabling our experts to use their sector-specific experience to address all market segments and clients. As such, our marketing and technical teams act in concert to implement efficient solutions to the most complex problems. This is one of the principal reasons why we are often able to respond quicker than other companies in the market.

Our medium – and long-term trends remain extremely promising. We must address numerous subjects with our clients: reindustrializing Europe and North America, environmental issues, energy sovereignty, healthcare, communications, defense, etc. Geopolitical crises and economic rebalancing at the continental level are causing uncertainties and holding back economic growth, but Scalian’s outlook remains sound and the company has a strong position as a member of the Wendel group. Together, Scalian and Wendel are ready to take advantage of new opportunities.

How will the Wendel team help you to create value?

Our ambition is high and we focus on several geographic fronts and businesses. Our growth is driven by many sub-projects, requiring both strong coordination and attention to structuring our management team. We will create value in two ways, by achieving our objectives and by building a sound structure for Scalian that can support our efforts over the long term. We can benefit from Wendel’s experience and the support of the Wendel team to help us grow and develop and to structure our organization.

How do you guide your customers toward sustainable and responsible performance?

Scalian often provides advice on environmental issues, for example to ADEME, France’s ecological transition agency, to the European Space Agency, to the ONF, the French national forestry office, and to RTE, the French electricity transport network. Specifically, Scalian develops applications using algorithms and AI to decarbonize urban transport and logistics systems, to detect water pollution via satellite imagery, to manage woodland biodiversity also via imagery and to model energy management with the inclusion of wind farms.

All market sectors have been stepping up their initiatives to find the most suitable environmental compromises, and we believe that digital technologies have a significant role to play. Scalian is and will remain central to both present and future challenges.

Scalian often provides advice on environmental issues, for example to ADEME, France’s ecological transition agency, to the European Space Agency, to the ONF, the French national forestry office, and to RTE, the French electricity transport network. Specifically, Scalian develops applications using algorithms and AI to decarbonize urban transport and logistics systems, to detect water pollution via satellite imagery, to manage woodland biodiversity also via imagery and to model energy management with the inclusion of wind farms.

All market sectors have been stepping up their initiatives to find the most suitable environmental compromises, and we believe that digital technologies have a significant role to play. Scalian is and will remain central to both present and future challenges.

Yvan Chabanne, CEO of Scalian